In The Options Edge, Gallagher looked at performance of (some interpolated) At-The-Money straddles between 15 futures options to determine whether options are indeed traded at a constant premium over future realized volatility, and concluded that they are most likely not.

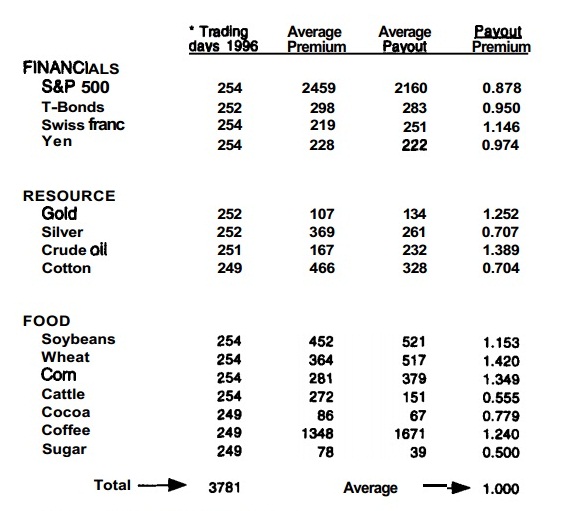

In the experiment, he held and rolled front month straddles til expiration, back to back. In the last column, a ratio of 1 would mean the premium paid was exactly at fair value, if the ratio is below 1 the sellers made money, and vice versa.

Here are the findings:

We can see that at least for the year 1996, futures ATM Straddles were roughly traded at fair value.

My personal take on this

The normal distribution assumption off Black Scholes valuation is most likely off, significantly.

Empirically, blindly selling options does not generate a positive E(PnL), i.e. Expected Profit/Loss, particularly after transaction, hedging costs. At the same time, this also means buying volatility through options does not always carry a cost, this then in turn could lead to some very interesting trading strategies with very favorable risk/reward potentials.

In the experiment, he held and rolled front month straddles til expiration, back to back. In the last column, a ratio of 1 would mean the premium paid was exactly at fair value, if the ratio is below 1 the sellers made money, and vice versa.

Here are the findings:

We can see that at least for the year 1996, futures ATM Straddles were roughly traded at fair value.

My personal take on this

The normal distribution assumption off Black Scholes valuation is most likely off, significantly.

Empirically, blindly selling options does not generate a positive E(PnL), i.e. Expected Profit/Loss, particularly after transaction, hedging costs. At the same time, this also means buying volatility through options does not always carry a cost, this then in turn could lead to some very interesting trading strategies with very favorable risk/reward potentials.