- If you know only yourself or the enemy, you are expected to win about half of the battles.

- If you know both yourself and the enemy, you are expected to win most of the battles.

How does that apply to trading?

Simply crunching numbers, trying to find gratuitously complex patterns alone is not enough. There is no edge, profit, trying to blindly forecast what other traders are likely to do going forward. People improve their execution algorithms almost everyday (at least I do), just so no pattern based traders couldn't exploit them.

You must understand and create trading strategies based on what other traders are doing, they are the enemies who work day and night to take your money.

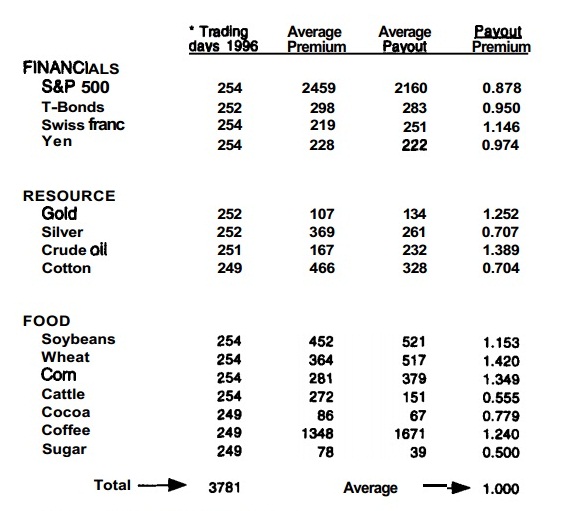

An example of monitoring what the NYSE traders are up to:

full size link: http://oi40.tinypic.com/mk8bhc.jpg